Auto refinancing when you have bad credit is not impossible. With the growth of the Internet there has been expansive growth in the number of lenders that are available. When you want to refinance, having bad credit is a hurdle, but it is not a hurdle you cannot overcome.

If you refinance your auto you may be able to:

-

- Lower your monthly payment.

-

- Lengthen your contract term.

-

- Avoid repossession or bankruptcy.

- Rebuild your credit.

It may be to your advantage to refinance your auto. Here are a few things you can try to do to get your refinance deal approved if you have bad credit:

-

- Locate at least 5 companies online. The internet has made it easier than ever to locate lenders that deal in high risk loans for borrowers with bad credit.

-

- Apply to all 5 lenders. You’ve already got bad credit, you don’t need to worry about too many credit inquiries hitting your credit report.

-

- Play the lenders against one another. A lender may make you a better offer if they know what their competition has already offered you.

- If you can, accompany the refinance with a secondary down payment. If you can increase the amount of equity you have in the vehicle, you have a much better chance of getting a refinance deal approved when you have bad credit

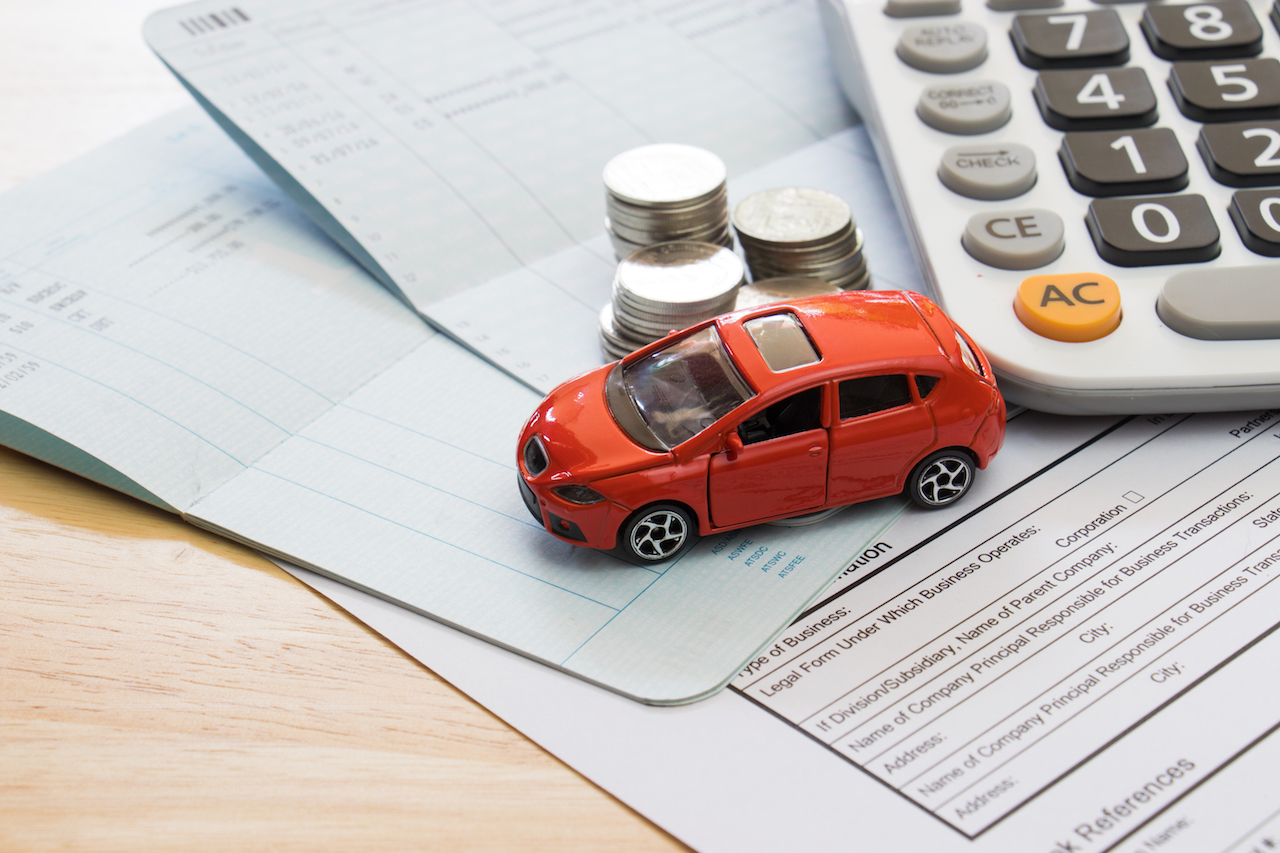

There is no doubt that getting your vehicle refinanced when you have bad credit is a challenge. However, it is not impossible. As with any lending deal, the outcome will be based on your current FICO credit score, your past credit history, the amount of equity you have in the vehicle, and the current economic climate. When a lender has excess funds to lend they will be more likely to make high risk loans. In times where lending capital is scarce, lenders will hold on to their funds and only make loans to lower risk borrowers (people with good credit).